One of the consequences of the European “Enlightenment” was the relegation of religion, in the name of reason and inquiry, away from the public sphere of life to the private domain alone. This has resulted in a conception of religion in contemporary Western thought different to that in the Islamic tradition. Religion in the West is conceived as a set of rituals, moral principles and, at the most, some rules whereby a person guides or regulates his or her private life. As for questions of economics, financial transactions, social interaction, judicial principles and politics, this is the domain of enlightened human reason, not divine injunction.

Islam categorically disavows such irrational absurdities. The Creator of the heavens and the Earth has both the Command over His Creation and is the best source of solutions to all human problems – private or public, spiritual or political, social or economic.

The dominance of Western culture around the world however has blunted the clarity of this understanding in the minds of many Muslims. Thus whilst there is little disagreement of matters of prayer, fasting and the Hajj, when it comes to matters of financial transactions and economic issues we find a myriad of opinions and at times great confusion among the masses.

The matter of Riba is one such issue: a matter dealt conclusively by the classical scholars (notwithstanding differences in the details) but the subject of much controversy in modern times. In this brief piece, we intend to clarify some of the important points on the matter of Riba so that we are clear as to what our obligations are in avoiding what Allah has definitively judged to be prohibited.

What is Riba?

Linguistically the word riba in Arabic means increase, growth or addition. It is usually translated in English as interest or usury, although it is a wider concept than this.

As for its technical meaning, which is what matters, riba is actually more dynamic a concept than many of us may understand. It can occur in more than one form of contract and in more than one way. At the most basic level riba is the taking of wealth (property) in exchange for wealth of the same genus but with disparity. In simpler terms it is to exchange in the same type of commodity but at unequal amounts. Further it is classified broadly into two types:

- Riba al-Fadl: this is where the excess which results in disparity is due to unequal exchange of the commodities involved.

- Riba al-Nasi’ah: this is where the excess which results in disparity is due to postponement of time.

Importantly, riba can occur in three types of contract: the contract of sale (bay‘), a loan contract (qardh) and the “forward” contract (salam) (not the same as the derivative forward contract in modern finance).

As for the contract of sale it is the exchange of wealth for wealth with the (complete) transfer of ownership. The contract known as salam is to give a commodity to the other party on the spot and to agree on what is to be given in exchange at a later date. The loan contract is effectively a type of the salam where one gives a defined amount of wealth to the other party with an agreement as to when it will be paid back.

Having presented these preliminary technical classifications, let us bring them together and present some examples to gain a more practical understanding.

Riba al-Fadl is more relevant to the contract of sale. It occurs when one exchanges a commodity for a smaller or larger amount of the same commodity with someone else. For example, Zaid giving Khalid 2 dinars of gold in exchange for 3 dinars of gold, or 10 dirhams of silver for 15 dirhams of silver, or 2kg of wheat for 2.5 kg of wheat. This is riba and it is haram because of the saying (among many other ahadith) of the Prophet (SAW), narrated by Ubaydah ibn al-Samit (RA):

“Gold for gold, silver for silver, wheat for wheat, barley for barley, dates for dates, salt for salt, like for like, in equal amounts and hand to hand and if these types differed than sell as you wish if it is hand to hand.” (Muslim)

Due to the specific mention by the Prophet (SAW) of six particular commodities, the scholars differed as to whether riba in the contract of sale (or salam) occurs only with these six commodities (gold, silver, wheat, barley, dates and salt) or others as well. The difference rests on the question of whether the prohibition comes with an ‘illah (effective cause) which therefore allows analogy of these goods unto others. The scholars differed on whether there was an ‘illah and on what it was. However the details of these differences are beyond the scope of this article and hence will not be presented here.

As for Riba al-Nasi’ah it is more relevant to the loan contract and the forward contract (salam) because these contracts involve an element of time period. If any benefit is acquired on account of this time delay this is riba and is prohibited. With the forward contract this occurs when an article is sold on a deferred payment basis with an agreed time period and in the case of inability to pay an extension is given in return for an increase in the amount due. For example, Zaid sells Khalid a car for $5000 and agrees to give Khalid 3 months to pay the money. 3 months later Khalid can only pay some of the $5000 so Zaid gives him another 2 months but increases the amount due to $5500. The extra $500 is riba.

As for the loan, then riba is not restricted to any particular things for it involves only one commodity. Rather it can occur in the loaning of any commodity where one side acquires a benefit over and above the agreed loan amount. Thus any extra payment on a loan is considered to be riba and is unlawful, regardless of which party (creditor or debtor) pays the extra amount. For example, Zaid borrows $1000 from Khalid who agrees to pay back $1100 in 5 months time. Or he agrees to pay $1000 but the amount is increased later to $1100 in return for a time extension. In both cases, the extra $100 is riba.

Riba – the Hukm of Allah (SWT)

Riba is prohibited by the clear text of the Qur”an, by the Sunnah, and by the Ijma” of the Sahabah (RA). Allah (SWT) says:

“And Allah has permitted trade but prohibited riba” (al-Baqarah: 275)

Riba is also one of the most heinous sins in Islam. Allah does not declare war on any sinner in the Qur’an except the one who partakes in riba (al-Baqarah: 279), showing the severity of the sin. Further, the one who claims that it is halal has committed kufr by his rejecting that which is known to be of the deen by necessity. As for the one who accepts that it is haram but still engages in either taking or giving riba then he is still a Muslim but is committing a major sin, the gravity of which is illustrated in what Imam Muslim narrated from Jabir ibn Abdullah (RA) that:

“The Messenger of Allah cursed the who one takes riba, the one who gives it, the one who writes it, and those who witness it and he said, “they are all the same” “.

Given this it should be clear that riba, in all its forms is haram and must be abstained from. Notwithstanding this reality, some Muslims, even some scholars, have tried to find excuses to make riba halal in certain cases. This may well be understandable given the inherent reliance on and widespread influence of riba in Capitalist economics which has a firm grip on the world at present. In the prevailing reality it is indeed very difficult to buy a house, start or run a successful business, make profitable investments and the like without the use of contracts that involve riba. However this is no reason to lower the standard of the Shari”ah. No human has the right to change the judgment of Allah.

In the following we examine some of the reasons presented to suggest that riba is halal is certain cases, none of which are truly valid.

“Riba is usury, not interest”

Some people say that riba is usury, that is, a high or exorbitant level of interest, but that low levels of interest are not riba. They adduce the following verse as evidence:

“O you who believe, do not consume riba, doubled and multiplied, and fear Allah so that you may succeed.” (Aal-Imran: 130)

They say that here Allah says do not consume riba which is doubled and multiplied which shows that the intent is a high level of interest. However this a gross misinterpretation of the text, for as the scholars explained, the description “doubled and multiplied” is not a qualification for the prohibition but only a description of what was the practice of the people who engaged in riba at the time. The dealers would give loans on interest and then in the case of repayment being hard on the debtor they would increase the interest and give more time, not only once but multiple times. So the description was to specifically condemn this practice, but not to qualify the prohibition.

“Necessity”

There is a jurisprudential principle in Islam which states that “necessities permit prohibitions” (al-Daruraat tubeeh al-Mahdhuraat). In simple terms it means that a situation of necessity (darura) makes that which was haram halal for that situation alone. For example if someone is starving and they have only pork to eat, then eating that pork, which is usually haram, becomes halal. Some people use this principle to say that having a house is a necessity as is doing well in business so that the Muslim community can progress and so riba is allowed in some limited ways (to buy the first house for example).

This is no more than an abuse of the principle, because the necessity referred to is dire necessity: a situation which would mean you will either die or face similarly extreme repercussions (like starving in the case of the pork). As has been said:

“The necessity which allows usurious loans is the same necessity which allows eating the meat of a dead animal, pig and the like, in which case the one necessitated is exposed to perish from hunger, nakedness or losing lodging. Such is the necessity, which makes prohibitions lawful.”

Hence it would not be permissible to take out a loan on interest for the purchase of a house, first or last, unless one is in a situation of dire and extreme need, not just any need.

“Bank interest is not riba”

There were some fatawa by contemporary scholars claiming that bank interest is not riba. One such claim came from the Majma’al-Buhooth at al-Azhar in 2002. However this question of riba is not one of ijtihadon which differences of opinion can be entertained. The texts are clear and thus any fatwa to the contrary are to be rejected outright. In the particular case of al-Azhar, it is well-known that in the modern era government intervention through appointed positions has diminished its great status, and many an unacceptable fatwa has come from it. Besides, this question of bank interest was definitely judged to be haram by this same institute much earlier by the likes of great scholars such as Sh. Abu Zahra and Sh. Mustafa Zarqa. The present-day institute not only lacks this caliber but the government influence is all too obvious.

Fundamentally, as Mufti Taqi Uthmani said, the importance in the Shar’ah is always of the evidence from the Qur’an and Sunnah and not from the individual opinion expressed by some scholars.

Conclusion

It is narrated from Umar (ra) that he said:

“No one is to trade in our markets except the one who knows the fiqh of trade, otherwise he will fall into riba.”

It is extremely important for anyone who wants to engage in trade to study the rules of trade and contracts in Islam and particularly the rules of riba. Otherwise falling into sin is quite possible, even without knowing, and ignorance is not an excuse in these matters. The same applies to the common Muslim who may engage in business but wants to take out loans or make investments and the like. Living under a non-Islamic system which has riba running through its economic veins, it is all the more important for Muslims to be vigilant to protect themselves and fulfill their obligations to Allah, the Exalted.

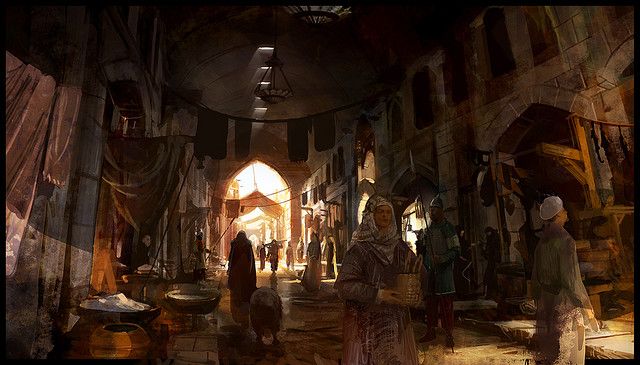

[Image Credit: Grand Bazaar in Constantinople 15th C, Artists’ rendition by Patrick Desgrenier and Nicolas Bouvier]

![]()